This caught my attention because TrendFeedr isn’t just cheerleading “AI + creators” – it threads the needle between trust, tools, and money flows. The report leans into a truth those of us building online feel daily: reach is cheap, trust is expensive, and the winners in 2025 are treating AI like a multiplier, not a replacement.

Creator Economy Report | TrendFeedr: trust over reach, AI as amplifier, own-your-audience urgency

Key takeaways

- Trust is the scarce asset: brands and creators with credibility are outperforming pure reach, pushing in-house creator hires and community-first plays.

- AI is finally practical: ideation, editing, translation, and ops are scaling output without (necessarily) killing authenticity-if you keep your voice front and center.

- Direct-to-fan is the default: memberships, subs, and niche communities beat algorithm roulette; Link-in-bio and owned funnels matter more than ever.

- Platform power remains real: YouTube’s economic footprint is massive, but diversification is insurance against policy shocks and geopolitics (hi, TikTok).

{{INFO_TABLE_START}}

Publisher|{publisher}

Release Date|{release_date}

Category|{category}

Platform|{platform}

{{INFO_TABLE_END}}

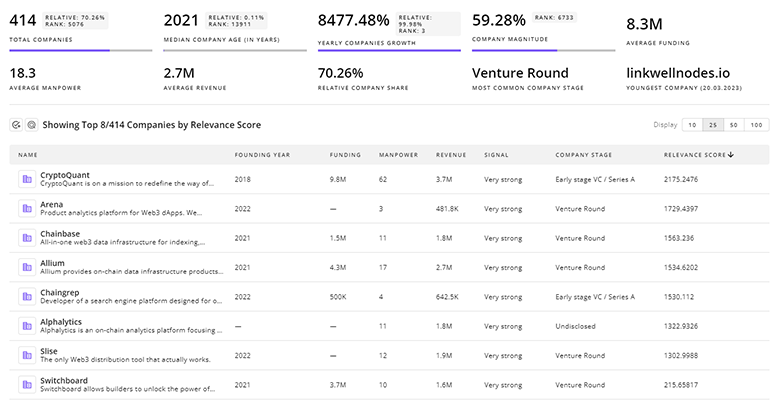

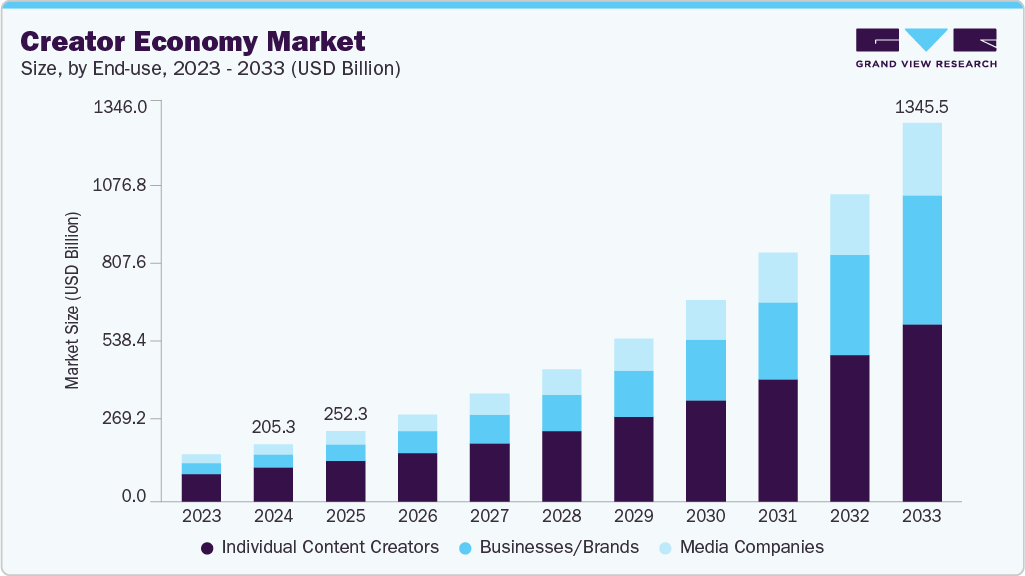

Let’s start with the money claims. TrendFeedr cites market estimates putting the creator economy at roughly $205B in 2024, heading toward $252B in 2025 and a potential $1.35T by 2033. Big numbers, big caveats. Depending on whose model you use, “creator economy” can include everything from YouTube ad splits to enterprise influencer software to Shopify stores run by creators. The direction is right-more dollars are flowing to creator-led distribution—but treat the trillion-dollar headline as a trajectory, not a guarantee.

The trust shift is the meat. If 88% of consumers say authenticity matters and two-thirds trust creator recommendations, that explains why we’re seeing employee-generated content explode. The listed $7k-$10k/month in-house creator salaries track with what I’m hearing from CPG and SaaS teams: hire a creator, ship daily native content, and stop renting authenticity via one-off influencer posts. It’s a smart move—if companies let those hires actually be creators, not branded megaphones.

On AI: this report gets the vibe right. Generative tools are now ambient—your editor, your thumbnail helper, your multilingual doppelgänger. I’ve seen creators use AI to turn a single video into shorts, captions, and translations in hours, not days. But the creators winning with AI are using it to amplify a distinct POV. When the tools start dictating tone, you get that uncanny sameness that tanks watch time and trust.

Globalization is the underrated unlock here. Multilingual channels are low-hanging fruit if you’ve proved product-market fit in one language. AI dubbing and cultural QA can open entirely new markets without spinning up a second team. The trap: literal translation without cultural translation. Local idioms, holidays, and platform norms matter—get a native reviewer in the loop.

The platform rankings mostly check out. YouTube remains the creator economy’s bond market—liquid, stable, essential. It’s hard to argue with a platform that reportedly contributed $55B to US GDP and ~490,000 jobs in 2024. Shorts is now a real discovery engine into long-form and memberships. TikTok still prints attention, but 2025 creators are smart to treat it as top-of-funnel given ongoing policy volatility. Linktree deserves its high placement for one simple reason: it reduces platform captivity by routing traffic into your owned funnel. Just remember, a link-in-bio isn’t true ownership—email and SMS are.

I’m glad to see community platforms like Mighty Networks and Discord get their due. The energy in 2025 is niche > mass. Private spaces with 1,000 true fans beat 100,000 passive followers nine times out of ten. That said, communities are labor-intensive. If you don’t budget for programming, moderation, and member journeys, they atrophy fast.

The monetization section mirrors what we’re observing: memberships (Patreon, Substack), live monetization (Twitch, TikTok gifts), plus commerce and affiliates stitched together by link-in-bio. CreatorIQ’s inclusion underscores the maturation on the brand side—deals are increasingly data-led, with measurement expectations that look a lot like performance marketing. Good for creators who can show ROI; tougher for vibes-only content.

Red flags worth calling out: algorithm dependence remains the silent killer. If one platform drives 80% of your traffic, you don’t have a strategy—you have a risk profile. Also, “AI music creation” is seductive but still a rights minefield; use reputable libraries (Epidemic Sound, etc.) and read the license fine print, especially if you’re distributing on platforms with aggressive content ID systems.

What this means if you’re building right now

- Anchor on one platform for depth, but build a cross-platform capture system (email/SMS, Linktree, landing pages) to de-risk distribution.

- Hire or become an in-house creator: daily native content wins—document, don’t overproduce.

- Use AI where it compounds: editing pipelines, multilingual dubbing, content repurposing, and analytics—not for replacing your voice.

- Stand up a paid layer early: even a $5/month tier on Patreon/Substack changes the economics and signals who your true fans are.

- Invest in community ops: events, rituals, and member-led programming keep retention high and churn low.

TL;DR

TrendFeedr’s 2025 read nails the current meta: trust beats reach, AI is a force multiplier, and direct-to-fan is table stakes. The big numbers are directional, not destiny—but the operating playbook is clear. Own your audience, use AI to work smarter (not blander), diversify your revenue, and build communities that can survive the next algorithm wobble.

Leave a Reply