This one caught my attention because it blends two things creators care about in 2025: predictable income (subscriptions) and the reality check on what “creator economy” numbers actually mean. Uscreen’s “75 Creator Economy Statistics for 2025” isn’t perfect, but the dataset lines up with patterns I’m seeing daily: transformation-focused niches thriving on direct revenue, live streaming doing serious engagement work, and international audiences quietly driving the next wave of growth.

Uscreen’s 75 Creator Economy Statistics for 2025 – signal, spin, and what to do about it

Key takeaways

- Subscriptions are winning where creators deliver recurring value (fitness, wellness, faith) – think high ARPU, lower ad-dependence, stronger retention.

- Live streams aren’t dead: 47-minute average watch times and small-but-mighty attendance drive conversions better than any “viral” short.

- International is the sleeper growth engine: 60% of revenue growth coming from non-domestic subscribers means localization isn’t optional anymore.

- Read the big numbers carefully: trillion-dollar TAM talk and “top 10% earnings” claims often reflect platform-specific slices, not the whole creator universe.

{{INFO_TABLE_START}}

Publisher|Uscreen

Release Date|2025

Category|Industry Research / Statistics

Platform|Web

{{INFO_TABLE_END}}

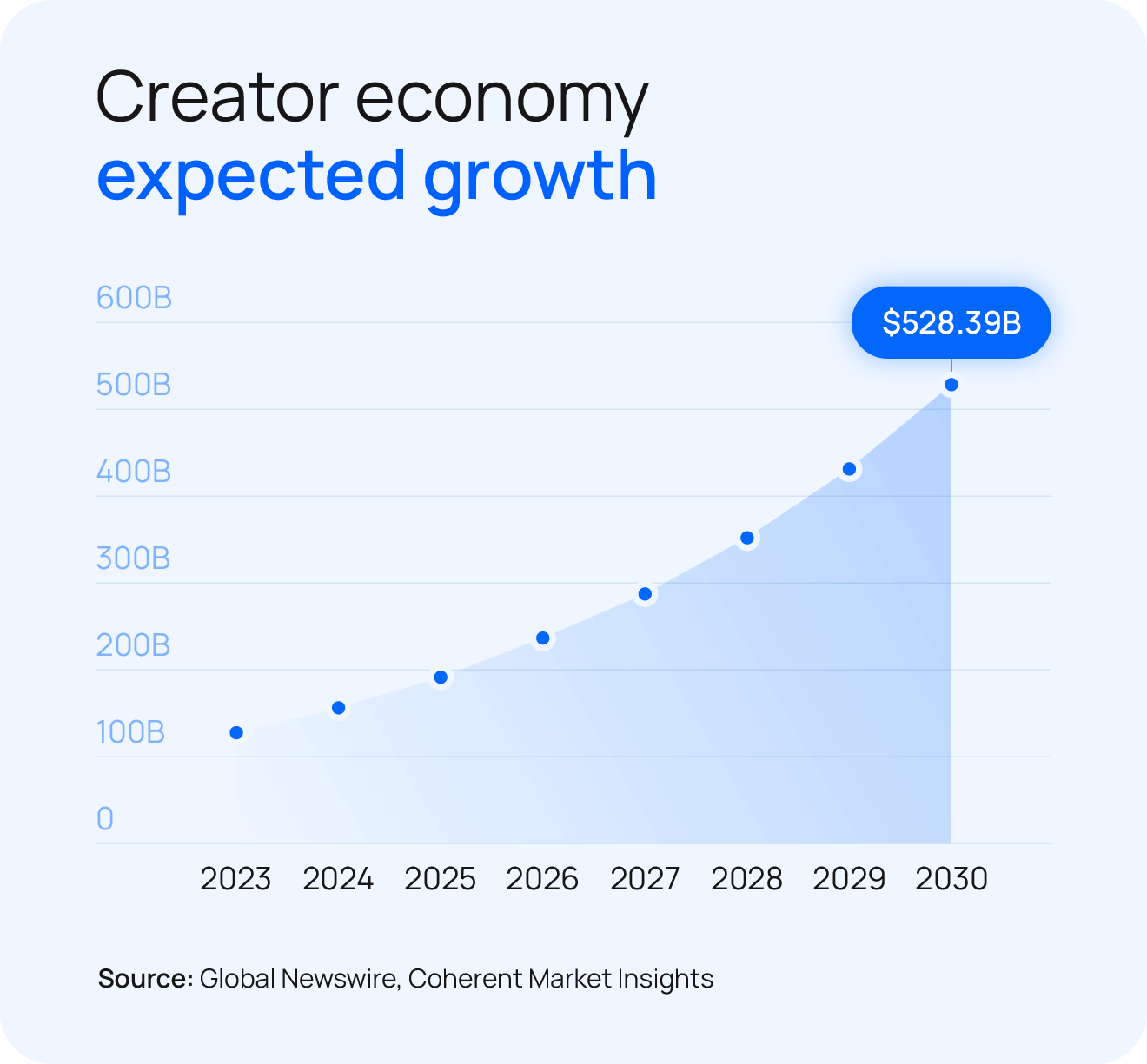

Let’s start with the headline stats. The report pegs the creator economy at roughly $205B in 2024, growing to $252B in 2025 and charging toward a trillion-dollar-plus horizon by the early 2030s. I’ve been covering (and operating in) this space long enough to know these totals are a Frankenstein of many markets: creator tools, ad platforms, agencies, and yes, creators themselves. Translation: good directional momentum, but don’t build your business off a trillion-dollar story.

The more useful signal is how money actually moves. Uscreen’s data shows subscription-led models averaging higher annual income than mixed models – no surprise if you’ve ever shipped weekly programs or courses. The niches leading the pack — fitness (~$11.9k/month), faith & spirituality (~$8.7k/month), yoga & wellness (~$8.3k/month) — are exactly where subscriptions shine: repeatable outcomes, habit-forming content, and a community that values consistency over novelty.

Here’s where my skeptic flag goes up: the “top 10% earners” figure. The report cites $14M per month collectively for that group, but also an average of $48.5k per month per creator. The math only works if the “top 10%” sample is a very small cohort (which it might be, if we’re talking about a platform slice). That’s not me calling out bad faith; it’s a reminder to treat platform-specific “top” metrics as directional, not universal. Most creators won’t see five figures a month without a clear offer, owned audience, and ruthless retention discipline.

The platform story tracks with 2025 reality. YouTube remains the discovery and ad engine, but the creators building resilience are tilting their monetization toward direct fan revenue. Uscreen (subs and live), Ko-fi (tips/digital goods), and Substack (paid newsletters) each map to different value propositions. The playbook I’m seeing work: use algorithmic platforms for reach, then convert serious fans into owned channels (email, SMS, paid communities, and yes, your own app).

Speaking of apps: Uscreen points to millions of active subscribers across creator apps and improved retention. That fits what we hear across the board — push notifications drive session frequency, offline playback cuts churn, and a home-screen icon beats a buried bookmark every time. If you’re running a programmatic content business (workouts, lessons, live cohorts), a branded app isn’t vanity; it’s LTV infrastructure.

Live streaming’s “resurgence” also deserves a closer read. Average sessions pulling ~179 viewers won’t impress a Shorts addict, but 47-minute watch times scream high intent. For coaching, worship, workshops, and member Q&A, that’s where conversions and community trust live. You don’t need 20k viewers; you need 200 who show up weekly and feel seen.

The international data might be the most actionable. With 60% of growth coming from outside creators’ home countries, the checklist is obvious and underused: multi-currency pricing, subtitles/closed captions, time-zone aware live schedules, and localized landing pages. If you’re still pricing only in USD and streaming at one fixed time, you’re leaving money abroad.

What this means for creators right now

- If you deliver transformation (learn, move, heal, build), prioritize a subscription core. Ship a weekly cadence, anchor with live touchpoints, and package programs into annual plans to cut churn.

- Keep social for discovery; move depth to owned channels. Build an email list, launch a simple app, and make your member community the “backstage” fans actually want to pay for.

- Go global on purpose: captions, localized pricing, and region-specific promos. Test Spanish/Portuguese first if your analytics hint at LATAM momentum.

- Instrument your business like… a business. Track cohort retention, LTV, and CAC. If you don’t know your monthly churn, you’re guessing.

- Reality check your goals: the median creator won’t hit $8-12k/month. The 1,000 true fans thesis still works — but only if you deliver predictable value every week.

Zooming out, this report’s strongest signal is cultural, not just financial: the creator economy is professionalizing around direct relationships. Ads and brand deals will keep swinging with algorithm weather; subscriptions, live programming, and apps are the umbrella.

TL;DR

Uscreen’s 2025 stats reinforce what many of us already feel: direct-to-fan beats platform roulette. If your content drives repeat outcomes, build subscriptions, add live, launch an app, and localize. Treat trillion-dollar forecasts and “top 10%” flexes as context, not destiny — your moat is retention, not reach.

Leave a Reply