This caught my attention because it’s the exact kind of “ultimate guide” creators bookmark-and then get burned by when outdated platform info sneaks in. VdoCipher’s 2025 Creator Economy guide rounds up smart monetization tactics, but it also repeats a few 2021-2022 era claims that will steer newcomers wrong if they don’t have context. Let’s separate the genuinely useful from the marketing gloss-and talk about where DRM/OTT actually fits in a creator’s stack.

VdoCipher’s 2025 Creator Economy Guide: what tracks, what’s outdated, and what matters now

- Diversify or die is still the rule: ads + direct-to-fan + productization beats any single platform play.

- Some platform details are dated: Shorts Fund and TikTok’s Creator Fund are gone-revshare and new programs define 2025.

- DRM/OTT can be a revenue unlock for courses and B2B education—but it’s overkill for most entertainment creators.

- Live content converts, but not 40% for cold traffic; plan for realistic 5-15% unless your list is warm and primed.

{{INFO_TABLE_START}}

Publisher|VdoCipher

Release Date|2025

Category|Guide/Report

Platform|Web

{{INFO_TABLE_END}}

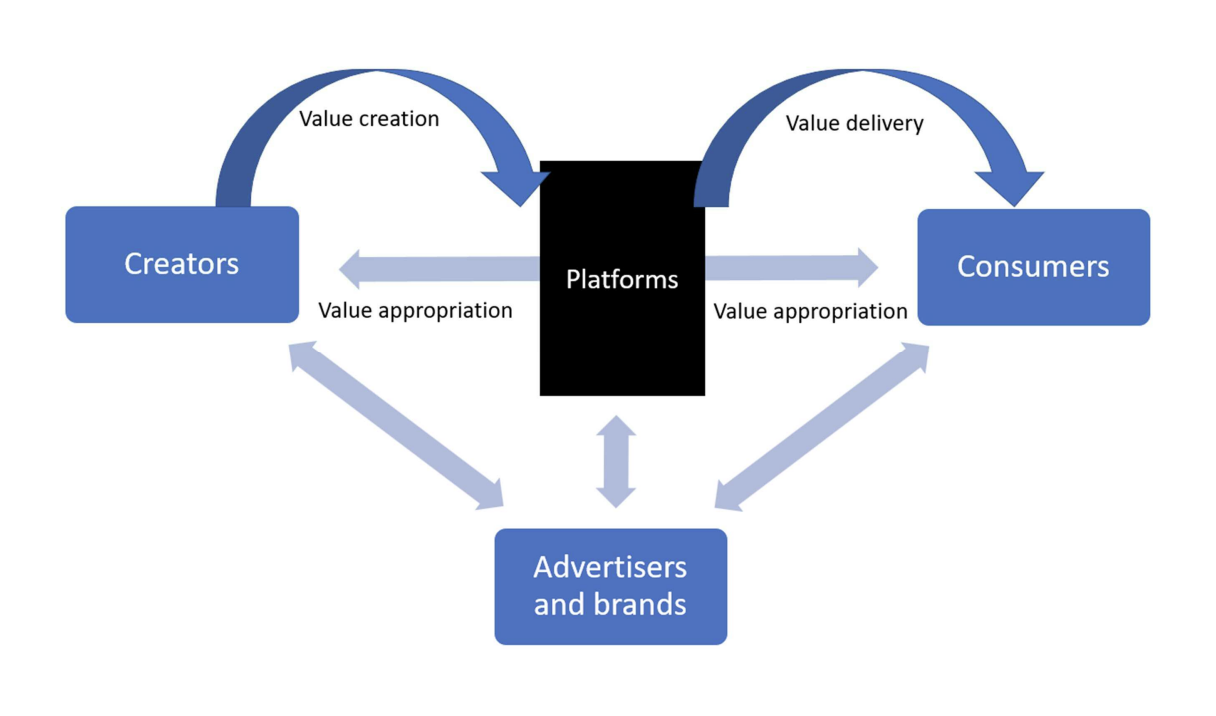

Big picture first: the guide’s headline numbers—$190-250B creator economy today, $1.1T by 2034—signal momentum, but I always caution readers to ask what’s being counted. Many market estimates roll in everything from SaaS tools to merch logistics and agency spend, not just creator payouts. Useful for macro trendlines; not a paycheck forecast.

Where VdoCipher nails it is strategy mix. The playbook—ads, brand deals, memberships, digital products, and tips—still works in 2025. The emphasis on owning your audience via email, memberships, and paid communities is exactly right. I’ve watched too many mid-tier channels crater when an algorithm tweak kneecapped their reach. Your list is the insurance policy.

Now the parts you should update before you act:

- YouTube Shorts: the $100M Shorts Fund is history. In 2025, Shorts monetization runs through YPP revenue sharing. Expect modest RPMs vs long-form, but it’s a top-of-funnel monster that can feed your longer videos, live streams, and memberships.

- TikTok payouts: the old Creator Fund is sunset. Today it’s the Creativity Program (longer videos, higher payouts for watch time), TikTok Pulse (ad revenue share for brand-safe inventory), and TikTok Shop driving real GMV for product-led creators. Plan content around those rails, not the legacy fund.

- Instagram Reels bonuses: the Reels Play program has been paused or limited in many regions since 2023. Reels still matter for reach; the money tends to come from brand deals and Shops, not bonuses.

- YouTube RPMs: $3-$5 per 1,000 views is a rough median, not a rule. Finance, B2B, and software education can see $10–$30+ RPM; entertainment and general lifestyle can sit under $2. Make your niche choice with RPM reality, not averages.

VdoCipher’s angle is DRM and OTT, and that pitch actually makes sense for a subset of creators. If you sell courses, certification prep, cohort programs, or high-ticket B2B education, piracy hurts and gated delivery increases perceived value. A DRM-first host with granular access control, watermarking, and app-level OTT can protect margin and enable institutional deals. I’ve seen creators jump from $49 Gumroad downloads to $499–$1,499 course bundles once the delivery felt “premium” and secure.

But DRM isn’t free—financially or friction-wise. For personality-led entertainment, vlogs, or commentary, the conversion drag from strict paywalls often outweighs piracy risk. In those categories, use lighter gates (YouTube Members, Patreon, Substack) and monetize the community with events, merch, and brand retainers instead of locking everything behind a custom app.

On live content and webinars: yes, live beats VOD for engagement and direct monetization (Super Chats, gifts, live shopping). The guide cites 20–40% conversion, which is possible for warm, segmented lists with a tight offer. For cold or mixed audiences, 5–15% is a more honest planning number. Treat lives as both revenue and demand gen—repurpose clips to Shorts/Reels, push replays to search, and always drive to an owned asset (email or community).

The strongest advice here is the most boring: measure like a hawk. Track platform-level RPM/ARPU, conversion by funnel step, and the split between platform money (ads, revshare) and direct money (memberships, courses, consulting). My rule of thumb: once platform revenue is over 60% of your total, you’re exposed; once your owned revenue is over 50%, you’re building an actual business, not just a channel.

What this means for creators right now

- Fix your platform facts: Shorts = revshare, TikTok = Creativity Program/Pulse/Shop, IG bonuses = limited. Build to today’s rails.

- Design a 3-revenue-stack: one platform-native (ads/revshare), one owned (memberships/courses), one market-facing (brand deals or services).

- Consider DRM/OTT only if your core product is premium education or enterprise-facing content. Otherwise, keep paywalls light and scale the audience.

- Go live weekly, but price conservatively on conversion. Use lives to feed email and product launches, not just the tip jar.

TL;DR: VdoCipher’s guide gets the strategy mix right and reminds creators to think like operators, not just uploaders. Just update the platform mechanics to 2025 reality and be honest about where DRM fits. The winners this year will blend short-form reach with long-form depth, convert into owned communities, and productize knowledge in ways that don’t crumble when an algorithm sneezes.

Leave a Reply